TransferWise (now change to wise) is a well-established online money transfer platform that allows users to transfer money between over 60 countries.

The platform completes transfers in a short duration with some of the lowest costs online, making it one of the best options for online money transfers.

The company has a unique product that adds to its worldwide popularity.

TransferWise has many competitors when it comes to competing in the money transfer market. These consist of competitors, such as Western Union or MoneyGram, that allow users to transfer money offline.

Similarly, it includes other online platforms, such as the well-known PayPal or WorldRemit, which deal with online transfers. However, despite its strong competition, TransferWise has held a place in the market through its services and low prices.

Using the platform is straightforward and does not require any technical knowledge. It is one of the reasons why users prefer TransferWise to its competitors.

Despite the ease of use, some users don’t know how the platform works.

How does TransferWise work?

TransferWise works in a few simple steps. Given below is a general overview of how the platform works.

Choosing a transfer route

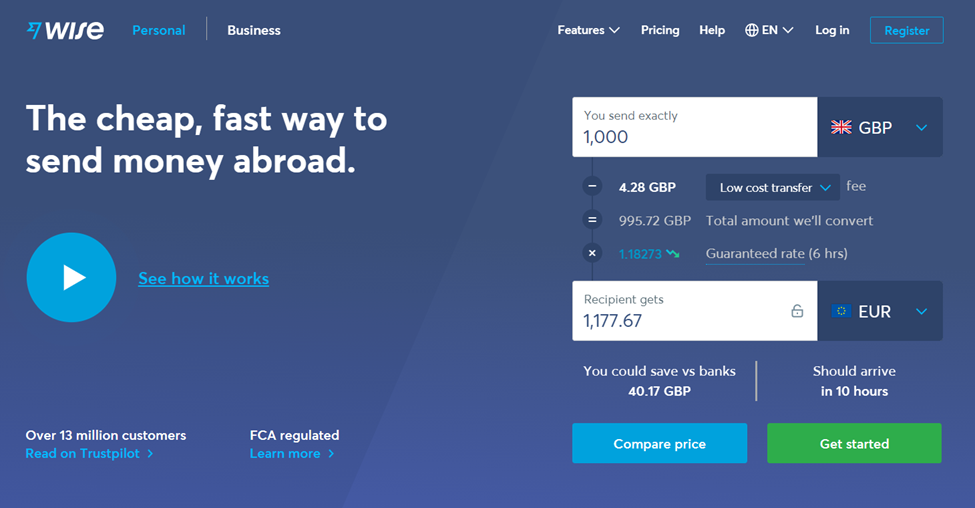

The first step, for a new user, to get started is to head over to the TransferWise website and select the amount they want to transfer and the currencies involved.

By choosing the currencies and amount of transfer, the user receives a quotation for the service, which is the price that the platform will charge them.

Users can also choose between three types of transfers, low cost, fast and easy, or advanced transfer. The fee charged depends on which method the user chooses.

The platform also provides users with a real-time conversion rate to allow users to determine how much the recipient will receive.

Similarly, the platform also tells the users about the costs they save by using TransferWise instead of local banks and the estimated delivery duration.

Finally, the platform provides a handy comparison of the rates the user will have to pay using other services, some of which are TransferWise’s competitors.

Once users choose to transfer their money through TransferWise, they can click on the ‘Get Started’ button to start using the platform and its services. However, users must first register with the platform.

Creating an account

The next process in using TransferWise is to create an account on the platform. Creating an account is simple. Users must provide basic information, including email address, password, and country of residence.

Users can skip registration by signing up with their Apple, Google, or Facebook accounts. They also need to select the type of account they want to create, personal or Business.

There are many differences between personal and business accounts. Business accounts give users additional features such as balance, invoice management, and the use of TransferWise’s free API.

However, users need to provide additional details regarding their business and other documents, such as VAT registration documents.

Some personal accounts, depending on the user’s country of residence, may also need to provide the platform with some verification documents. The verification process usually takes between 1-3 business days.

Sending money

Once users register on the platform and have their accounts verified, they can start sending money to other parties. The recipient of the money does not need to have a TransferWise account.

The user, in this case, the sender, must give the receiver details to the platform. Similarly, TransferWise also requires the user to provide their local bank details.

Once users finalize the details, they need to pay for the transfer. The platform allows users to pay through either credit card or a local bank transfer to TransferWise’s bank account in their country.

TransferWise may also need users to link their bank accounts to their accounts if they are sending from Canada or the US. Some countries may also have additional payment options that users can use.

From there, TransferWise takes care of everything. The platform links local bank accounts in countries all over the world using its smart technology.

Therefore, it can use money from a user sending money the other way round. Once TransferWise matches the amount with another use, it will give users an estimate of when it will arrive, which is significantly faster than bank transfers.

The platform also lets recipients know about the receipt through email if the user gives that information. Usually, the money reaches the recipient within the estimated time, sometimes even earlier.

Conclusion

TransferWise is a platform that allows users to transfer money in over 60 countries worldwide. The platform is straightforward to use.

First of all, users need to give details about their money transfer to TransferWise.

However, if users don’t have an account on the platform, they need to register first. From there, they can transfer their money to the receiver, and the platform takes care of the rest.