Key Takeaways:

Groupon is an American online e-commerce marketplace founded by Andrew Mason, Eric Lefkofsky, Brad Keywell in 2008. The platform provides deals, services, goods, travels, or activities from local merchants and any specific location a person might search for. The platform operates in 15 countries in America, Asia, Europe, and Africa and can be accessed through a mobile app for Android and Apple and their desktop sites.

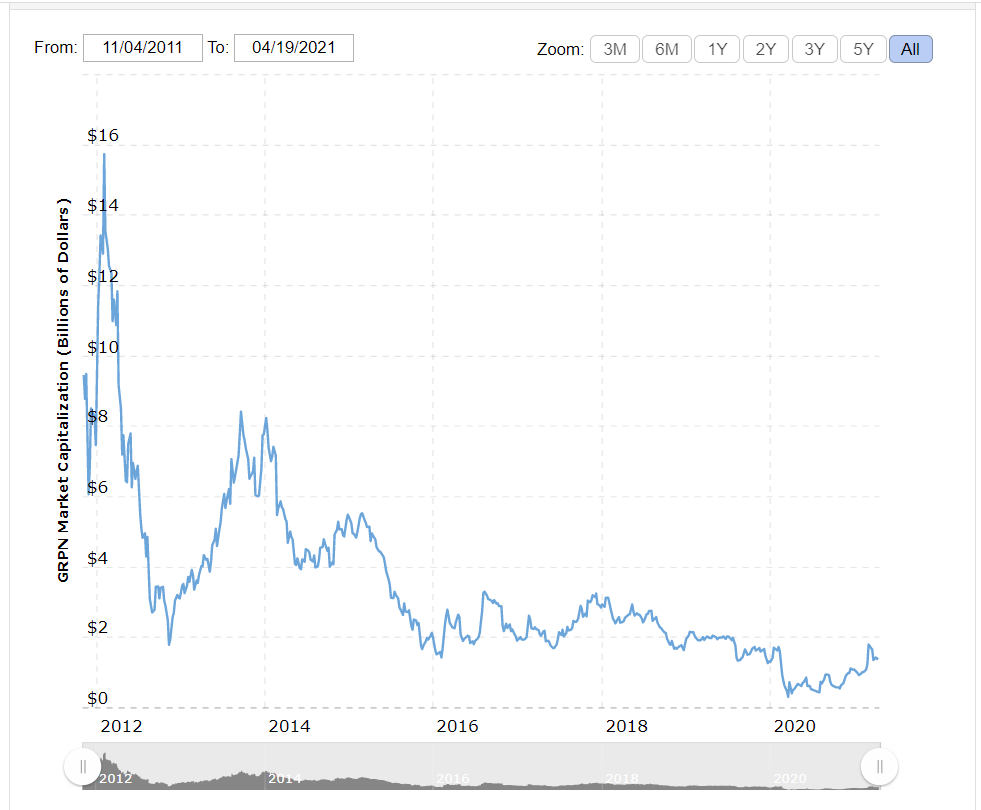

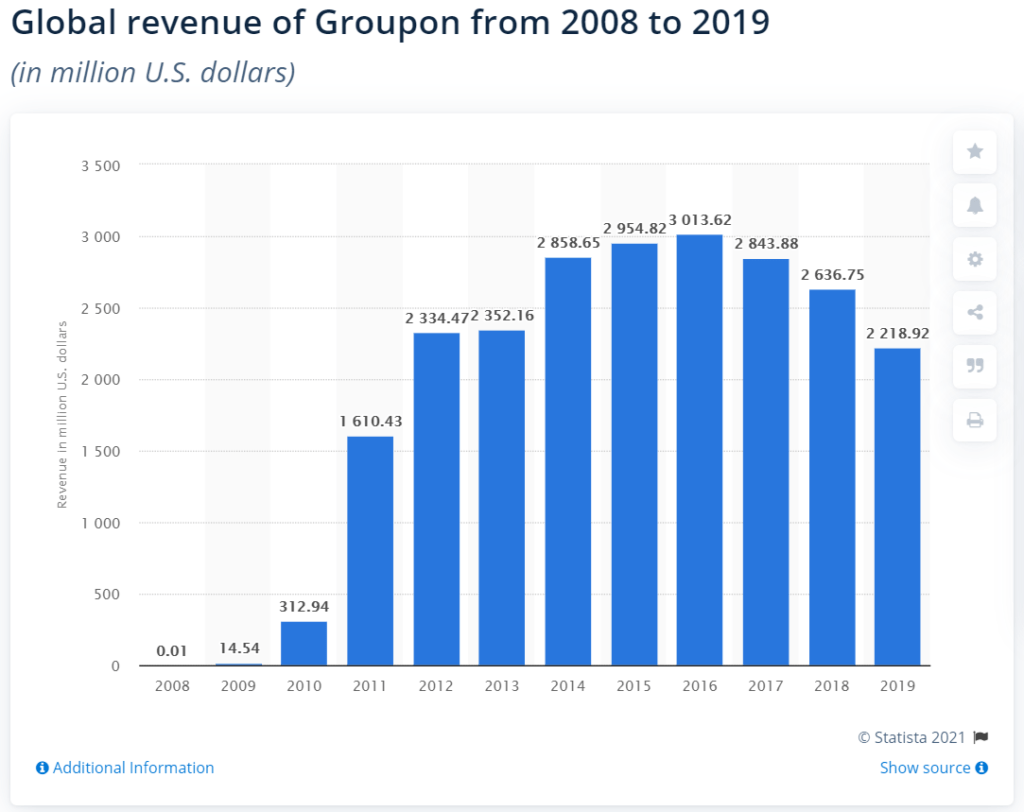

The revenue generated by the company comes from the commission the platform charges for promoting and attracting more customers to a business. As of March 2021, the net worth of Groupon is $1.7 billion. The company closed the year 2020 with $1.4 billion in revenue, which has dropped down quite a bit. The company’s revenue has constantly been fluctuating, but still, it made enough to reject Google when it was approached by them to buy out for a hefty price.

Company Profile:

| Company Name | Groupon Inc. © |

| Website | groupon.com |

| Founded- In: | November 2008 |

| Headquarters: | Chicago, Illinois, United States |

| Founders | Andrew Mason, Eric Lefkofsky, Brad Keywell |

| Key People | Aaron Cooper (Interim CEO), John Higginson (Chief Technology Officer), Melissa Thomas (CFO), Simon Goodall (Chief Commercial Officer), Barbara Weisz (Sr. Vice President), Dane Drobny (General Counsel & Corporate Secretary), Claudine Kourkoumelis (Chief People Officer), Eric Lefkofsky (former Chairman and Director) |

| Business Model | Online deal marketplace, Electronic commerce |

| Product/Services | Electronic commerce, coupon provider |

| Competitive Advantage | Brand Recognition, International Presence (Global) |

| Revenue | $1.42 Billion as of ending of 2020 |

| Competitors | eBay, RetailMeNot, Scoopon, Gilt City, Scoutmob, Yipit, CouponX |

What is Groupon?

Groupon is an online e-commerce marketplace. The platform provides deals, services, goods, travels, or activities from local merchants and any specific location a person might search for. The platform operates in 15 countries in America, Asia, Europe, and Africa and can be accessed through a mobile app for Android and Apple and their desktop sites.

The advantage of the platform is that you, as a shopper and customer, can save up to 70% of almost everything by utilizing the virtual coupons provided by Groupon, and it can be anything. Suppose you are near a store, the Groupon platform will inform you about the deals provided to get and use a virtual voucher before buying anything. You can also search these deals by yourself for the local area. These deals can be bought online without any fuss.

To summarize, the customers can buy anything, ranging from goods to services, and traveling at a discounted rate by using the platform’s virtual coupons or deals. It focuses on the local market to see more variety of all the services on the site.

The company’s revenue has constantly been fluctuating, but still, it made enough to reject Google when it was approached by them to buy out for a hefty price.

A Short History Of Groupon:

The concept of Groupon was born out of its founder, Andrew Mason’s irritation, in 2006 when he tried to cancel his cell phone contract. He’s thought about the public’s collective power and a place to marginalize that power led him to found The Point in 2007 to bring people together from social media to achieve any sort of goal.

The only reason that platform became famous because a group of people made saving money their cause. The resulting circumstances made the co-founder, Eric Lefkofsky, think of making a platform focused only on group buying, and hence, Groupon was born.

The name Groupon is a mixture of words group and coupon. This business’s first-ever deal was the offer of buy one get one free pizza (getting two for the price of one) in a shop located in its own headquarter.

The three co-founders had applied The Point technology on the concept of group buying, which in hindsight proved to be very successful. Just in a few years, the company grew to a point where it even rejected Google’s offer to buy it out. Groupon’s success rate was phenomenal, as its net worth becomes more than $1 billion only after 16 months of its launch.

The platform went publicly traded platform in 2011. Not only that, they had bought SoSasta.com, an Indian deal of the day site, earlier in that year. It was renamed, Craze. They had also started to offer deals for a small amount of time, named Groupon Now deals.

Their decision to go public allowed them to expand their business. They acquired another company, a point of sale system called Breadcrumb. They also got an iPad app whose purpose was to target restaurants in local areas in 2012.

Although the company started with a bang, it was not supposed to remain that way. The stock went down by 75 to 80% after the company went public, but it recovered its revenue in the next four years.

To recover that revenue, though, they used many strategies, including Glassman’s acquirement (founded by Geoffrey Woo, Jon Zhang, and Jonathan Chang), a real-time location sharing mobile app, and a small business service provider. Again, misfortune came, but this time it was not for the company as much as it was on one of its founders. At the beginning of 2013, Mason was ousted from the CEO position.

The business went on to acquire another company. This time it was a fashion company named ideeli in 2014 for $43 million. At the end of that year, the company reacted to Amazon.com’s December announcement on drone delivery with Groupon catapults’ plan. By now, the stock price was rising gradually.

The year 2015 was a bit different for the company. By now, they had recovered the stock price that had plummeted in previous years. Not only that, the new Chief Operating Officer Rich Williams was given the position of CEO in November. The company had also eliminated around 1,100 positions in sales and customer service operations. In the same year, the acquisition of OrderUp, a food delivery service, added another company to be included in the Groupon banner.

As successful as 2015 was for the company, 2016 proved to be a bit different. At the beginning of the year, Alibaba, an online Chinese retailer company, revealed that they had acquired a 5.6 stake in Groupon Inc.

Later, IBM was sued by Groupon, with the claim that they had infringed on the patent of technology (it allowed solicitation customers based on where the customers are located). Near the end of the year, the company’s coverage area had been whittled down to 15 countries from 27.

Other notable history included their partnership with Universal Orlando theme parks in April 2018. Later in that year, they took over Bristol, a UK-based Cloud Savings company, for $65 million. In the March of 2020, it was announced that the company’s CEO, Rich Williams, and Chief Operating Officer Steve Krenzer have stepped down from their roles. They were still employees of the company, though.

In addition to all the acquisitions as mentioned above, they also bought out Mob.ly (mobile technology company in 2010), Obtiva in 2011 (a Ruby on Rails and Agile Software Development consulting firm) to boost Groupon’s technology recruiting capabilities, Savored in 2012 (restaurant reservation and discount), Boomerang at the end of 2013 (a platform that enabled people to share gifts and deals from local sellers or merchants to their friends.

This led to the start of Groupon Coupon, a new digital offering of the company), Blink in the same year (a site that provides hotel reservations to travelers on the same day), Snap-in 2014 (an app that was specifically built to return cash to the shoppers upon buying specific items from a grocery store). They also acquire LivingSocial in October 2016, a daily-deals provider.

How Does Groupon Make Money?

Groupon provides a link between customers and businesses or merchants at the local market. As it is a middleman between sellers and buyers, the source of most of its revenue is the establishment of that link. In other words, the platform sells deals and discount coupons to the customers.

When that customer is referred to a merchant, the platform pockets some money as a commission for providing that link between the buyer and seller.

Keep in mind that Groupon is a two-sided marketplace. The platform gets to promote businesses and merchants online, which helps them get more customers. In return, Groupon demands a commission from the business. As they partner up with local businesses there is a diversity and variety in the services and products you can get.

Let’s break down the revenue sources for Groupon.

- Direct Sales:

Although the company has a partnership with other sellers, it sells various products and merchandise to online shoppers without involving any third parties in some cases.

- Vouchers, Tickets, Coupons, and Card-linked Deals:

Vouchers and coupons are the biggest revenue generator for Groupon. The platform has now started to focus on card-linked deals to make the process smoother for customers.

- Offerings and Deals:

Coupons and vouchers are the biggest revenue generators for the business. Groupon provides offerings and deals from local sellers. This way, shoppers can buy goods at a reduced price, and the business gets to promote itself and increase its client base. The company charges a commission per sale. The offerings are divided as follows:

- Local services: by the partnership between Groupon local plus national merchants.

- Goods: both direct and third-party sales

- Travel: different traveling offers like hotel reservations, restaurants, tickets, etc.

Fun fact, many of the customers visiting the website end up spending more than what they tried to save. Pretty neat for the company, huh?

- Advertisement of Business and Services:

It might seem like the business face a net loss by offering products at discounted rates, but the opposite is true. Groupon essentially advertises the sellers, both international and local, which increases their number of customers by a large margin. For this promotion, the merchants have to pay some fees to the platform.

Groupon Funding, Valuation & Revenue:

Atairos Management LP, one of the most notorious investors of Groupon, which also has ties to Comcast Corp, has given $250 million in funding to the company in 2016. Then there is Alibaba, a Chinese online retailer company that acquired a stake of 5.6% in Groupon.

As of March 2021, the net worth of Groupon is $1.7 billion. The company closed the year 2020 with $1.4 billion in revenue, which has dropped down quite a bit.